Why Every Home Customer Requirements a Reliable Home Loan Calculator for Financial Clarity

Why Every Home Customer Requirements a Reliable Home Loan Calculator for Financial Clarity

Blog Article

Smart Loan Calculator Remedy: Enhancing Your Financial Calculations

Think of a device that not just streamlines complex financing estimations yet also offers real-time insights right into your monetary commitments. The clever funding calculator remedy is created to simplify your economic estimations, using a seamless means to assess and prepare your car loans.

Advantages of Smart Financing Calculator

When assessing monetary alternatives, the advantages of utilizing a smart financing calculator end up being noticeable in helping with informed decision-making. These calculators supply users with a tool to accurately figure out finance payment amounts, rate of interest, and payment timetables. Among the key benefits of utilizing a wise lending calculator is the capability to compare different funding choices quickly and efficiently. By inputting variables such as loan quantity, rates of interest, and term length, people can analyze various circumstances to choose the most economical option customized to their financial situation.

In addition, wise funding calculators provide openness by breaking down the overall cost of loaning, including passion payments and any kind of added costs. This transparency encourages users to recognize the financial ramifications of taking out a finance, allowing them to make audio monetary choices. Additionally, these tools can save time by providing instant computations, removing the demand for hand-operated calculations or complicated spreadsheets.

Functions of the Tool

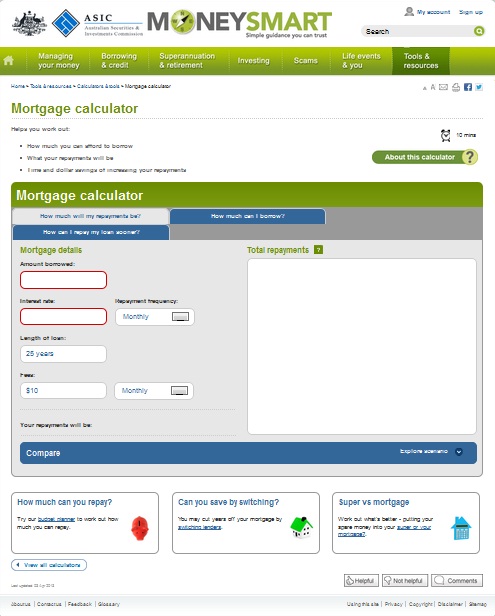

The device integrates an user-friendly user interface made to streamline the process of inputting and evaluating lending data efficiently. Individuals can conveniently input variables such as finance quantity, rates of interest, and car loan term, permitting for quick estimations of month-to-month repayments and complete rate of interest over the funding term. The device additionally uses the versatility to change these variables to see how changes impact the total lending terms, encouraging users to make enlightened economic decisions.

In addition, the wise loan calculator supplies a break down of each monthly repayment, revealing the section that goes towards the major amount and the passion. This function assists customers envision how their repayments contribute to repaying the finance with time. Additionally, individuals can produce comprehensive amortization timetables, which outline the payment routine and rate of interest paid monthly, assisting in long-term financial preparation.

Exactly How to Utilize the Calculator

In navigating the finance calculator successfully, customers can conveniently take advantage of the straightforward interface to input essential variables and generate useful financial understandings. Individuals can also specify the payment frequency, whether it's month-to-month, quarterly, or yearly, to align with their monetary preparation. By adhering to these easy steps, users can efficiently utilize the financing calculator to make educated financial choices.

Benefits of Automated Computations

Automated calculations simplify economic processes by promptly and accurately calculating complex figures. One of the vital advantages of automated estimations is the decrease of human error. Hand-operated estimations are prone to errors, which can have substantial implications for monetary choices. By utilizing automatic tools, the threat of mistakes is minimized, ensuring higher precision in the results.

Moreover, automated estimations conserve time and boost performance. Facility monetary calculations that would generally take a considerable amount of time to complete by hand can be done in a fraction of the time with automated tools. This allows economic experts to concentrate on evaluating the results and making notified decisions instead of spending hours on computation.

Furthermore, automated calculations supply uniformity in outcomes. The algorithms utilized in these tools adhere to the same reasoning whenever, ensuring that the calculations are consistent and reputable. This uniformity is crucial for contrasting different financial circumstances and making audio economic options based on accurate information. In general, the advantages of automated computations in enhancing monetary processes are indisputable, supplying boosted accuracy, effectiveness, and consistency in complex economic calculations.

Enhancing Financial Preparation

Enhancing monetary planning includes leveraging advanced devices and methods to enhance financial decision-making processes. By utilizing advanced monetary planning software program and calculators, companies and go to this website people can obtain much deeper insights into their monetary wellness, set practical objectives, and develop workable plans to accomplish them. These tools can examine different economic scenarios, task future end results, and give recommendations for efficient wealth monitoring and threat reduction.

In addition, improving monetary preparation encompasses integrating automation and synthetic intelligence into the procedure. Automation can streamline routine monetary tasks, such as budgeting, expenditure tracking, and financial investment monitoring, liberating try this web-site time for critical decision-making and evaluation. AI-powered devices can use customized monetary suggestions, determine patterns, and recommend optimal financial investment opportunities based upon private risk profiles and financial goals.

Additionally, partnership with financial advisors and experts can boost economic preparation by using useful understandings, industry expertise, and customized methods customized to particular financial objectives and conditions. By combining innovative devices, automation, AI, and expert recommendations, companies and individuals can elevate their economic planning capabilities and make educated choices to secure their monetary future.

Verdict

To conclude, the wise lending calculator solution offers many advantages and features for simplifying economic estimations - home loan calculator. By utilizing this tool, customers can quickly calculate loan repayments, rate of interest, and payment schedules with precision and performance. The automated estimations offered by the calculator enhance economic preparation and decision-making processes, eventually causing better economic monitoring and educated selections

The smart lending calculator service is made to streamline your financial computations, offering a smooth means to analyze and prepare your fundings. Overall, the advantages of automated calculations in improving economic processes are obvious, providing increased accuracy, performance, and uniformity in complex monetary calculations.

By making use of advanced monetary planning software program and calculators, people and services can gain deeper insights right into their economic health and wellness, set practical objectives, and establish actionable strategies to accomplish them. AI-powered tools can offer individualized economic advice, identify patterns, and suggest optimal investment chances based on individual risk profiles and financial purposes.

Report this page